Hi from the Aptos Experience in Brooklyn, it’s not too late to join us if you’re in town. We’re on stage tomorrow at 4:30 talking crypto marketing with Kim Milosevich, CMO at a16z crypto. Come thru!

Next stop is Buenos Aires, and we’re looking for partners. Could it be you?

Also - we’re livestreaming on Friday at noon with friends from 404 Media and more. Mark your calendar.

Warmest Regards,

The Boys

Writer: Deana

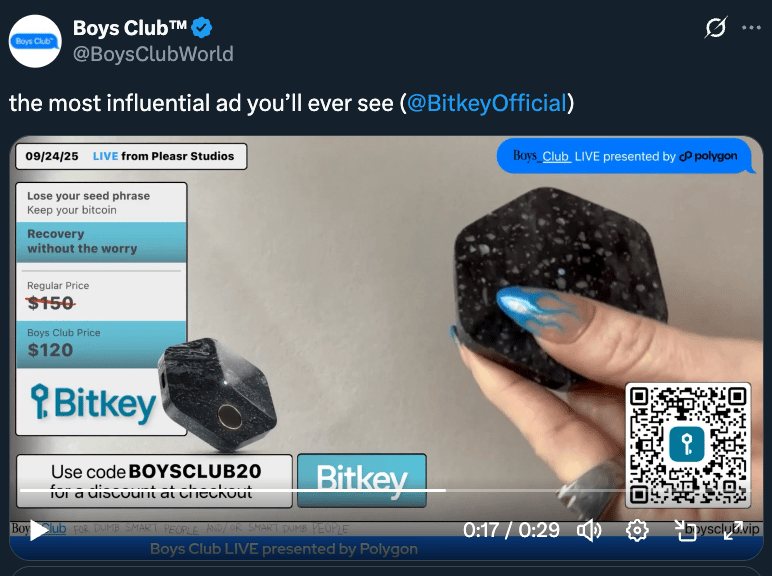

Say GOODBYE to seed phrases with Bitkey, a Bitcoin wallet.

Use code BOYSCLUB20 for a discount on your Bitkey.

The Nobel Prize Polymarket Drama. A scandal rocked the Nobel Prize committee in Oslo last week. Hours before the Nobel Peace Prize announcement on October 10, a brand new Polymarket account “dirtycup” bet roughly $70K on María Corina Machado to win, spiking her odds from about 3.7% to ~73%. Then, wouldn’t ya know it, Machado actually won. The Nobel Institute says a leak is “highly likely” and has opened a probe. Espionage? Or the workings of an extremely resourceful Wordpress dev who scraped their website to find clues in advance of the announcement? “If an edge exists, a prediction market trader will find it.” If this gets you going, you should read Chris Dixon’s take on the theory of Friedrich Hayek, and how this relates to the beauty of prediction markets.

Liquidated. Friday was a bad day for people who trade crypto with leverage. More than $19B in leveraged positions were liquidated in 24 hours after Trump did the China tariff thing again. (A quick lesson in how leveraged positions are calculated.) TLDR - DeFi largely held up to the stress test. Binance did not, with some major errors in asset pricing causing $283M in unnecessary user losses (which they are refunding.) It was a bad day for basically everyone except for this lucky chap! ⤵️

Quick Hits.

Waymo DDoS on a dead end street in San Francisco.

ChatGPT allowing erotica for “verified adults” in December. Happy holidays!

Man writing 5,000 stories of AI going well to teach the AI that things can go well.